BYE BYE PIGGY BANKS

Young people were the hardest hit in financial terms by the COVID-19 crisis: 61% experienced a loss in revenue and over half experienced anxiety over their debt levels. It’s a dark picture, yet one that seemingly hasn’t dulled their youthful optimism.

No time for looking back!

And this is just the beginning! In this province, where listenership remains lower than the Canadian average, the digital audio market still has some great opportunities for growth.

Hard-won maturity

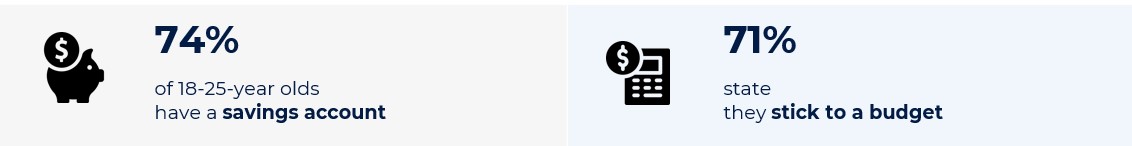

As inheritors of the 2008 financial crisis, young people agree on one thing: the importance of financial resiliency. Though they are the least financially literate group, they’re also the group that shows the strongest desire to learn more.

Savings: A key value

Source : Canadian Bankers Association, November 2021

This quest for financial security is something they share with the older generation. But the road they’re taking to get there, which lies somewhere between creative problem-solving and a taste for more risk, puts them at the opposite end of traditional financial strategies!

Banking institutions are losing ground

Sources : Canadian Bankers Association, November 2021 / Léger, Les Finances personnelles et les jeunes, December 2020 / Hardbacon, Survey, August 2021

Autonomy and the banking revolution

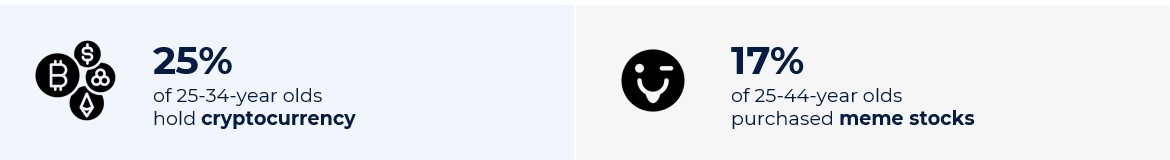

As users of online and self-learning tools, young adults massively invested in online trading in 2021.

And their presence on the stock market hasn’t gone unnoticed! As testified by the meme stock phenomenon, the upsurge in certain fetishized stocks is fed by huge online communities. Cryptocurrency, another colossal market driven by young people, surpassed $3 trillion in assets last month.

Investment that is anything but marginal

In Quebec:

Source: Vividata, Fall 2021, Quebec, 18+ / Hardbacon, Survey, August 2021

These potentially lucrative yet volatile assets reflect a common desire for early retirement (embodied by the FIRE movement) . . . though at the risk of losing their shirts!